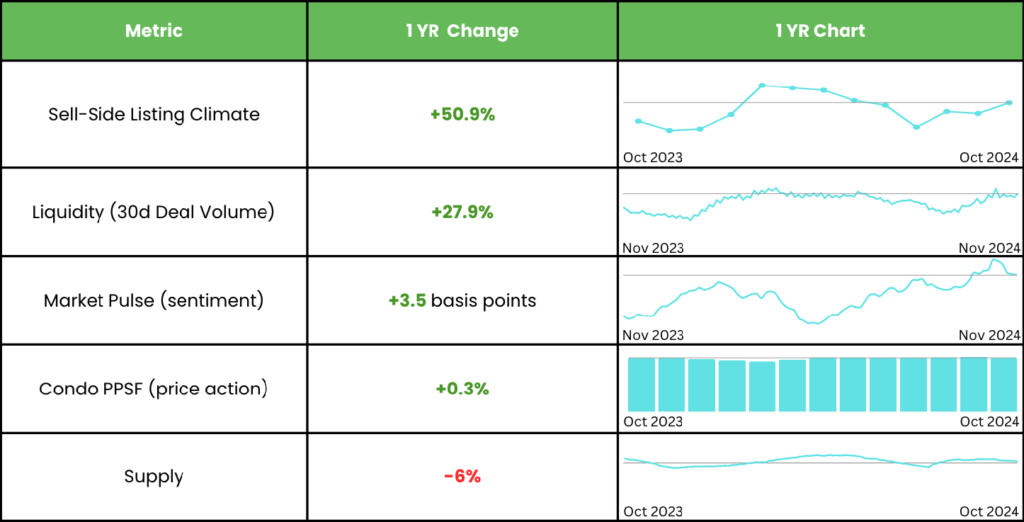

Now that the election is behind us, the real estate market is starting to settle down, and we’re getting a clearer picture of what’s ahead. As uncertainty fades, we’re seeing more contracts being signed, leading to a surprisingly strong end to the Fall season. This is happening even though interest rates are on the rise. The big takeaway? Confidence and clarity in the market seem to matter more than higher rates right now. The market is starting to bounce back after being stuck in a slow period for years. The big question is: will this recovery stick?

Here’s what’s happening: there’s less inventory, more deals getting done, and the balance of power is shifting slightly from buyers to sellers. For sellers, the environment is looking better. But when it comes to pricing, things are still lagging behind. That’s pretty typical since pricing trends usually take a few months to catch up. We’ll likely need to wait 3-4 months or more to really see how current deals affect overall prices.

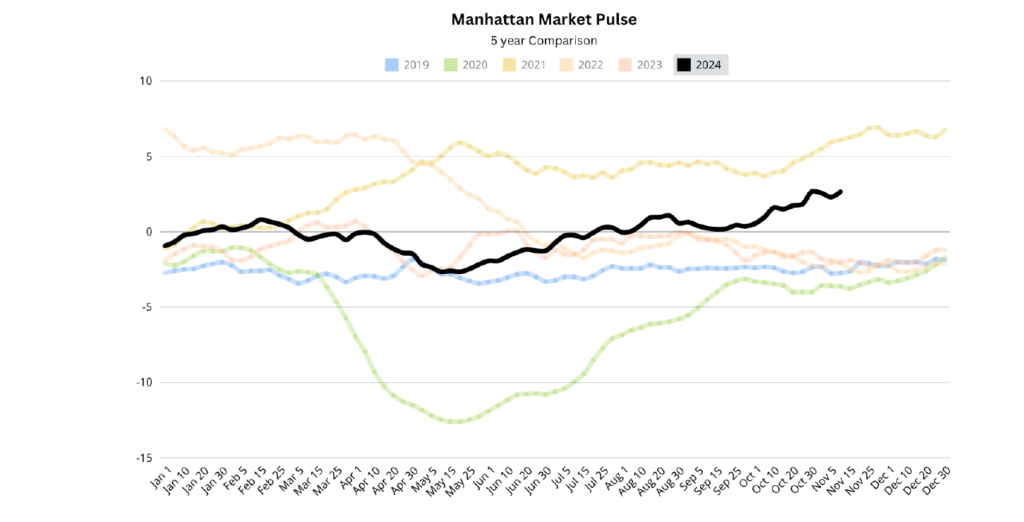

Looking at 2024 as a whole, we’ve been focusing on what we call “market pulse” trends. These trends look at supply and demand while accounting for the usual seasonal changes in the market. Basically, they give us a sense of who has the upper hand—buyers or sellers—or if things are balanced. The following chart gives you a bird’s-eye view of where we are now compared to the last few years.

No matter how you look at it, the market is in better shape than it’s been in the last couple of years. Unless something unexpected shakes things up—like economic issues or global events—Spring is shaping up to be a good season for NYC real estate. The big questions are: will this momentum keep going, and for how long?

Tips for Sellers: Be Smart About Pricing

If you’re selling, this is the strongest Fall season we’ve seen in years. But keep in mind that the market is just getting back on its feet, so it’s not a full-blown seller’s market yet. Right now, negotiation trends show buyers getting around a 4% discount. Sellers who overprice their homes from the start often end up taking bigger hits—up to 11% below their original asking price for homes that sit on the market too long (more than 4 months).

As we move into winter and the holiday season, things usually slow down until late February or March, when Spring activity picks up. If you’re planning to sell, be realistic about your pricing now and consider making adjustments to attract buyers during this quieter time.

Tips for Buyers: Stay Flexible and Look for Value

For buyers, it’s gotten a little tougher recently. Interest rates are higher, and the market is gaining confidence, which means less wiggle room in negotiations. But that doesn’t mean there aren’t opportunities. Many sellers still have overly ambitious asking prices, and by late December or January, you might find some who are ready to make a deal.

Here are two things to look for:

- Homes that have been sitting on the market for over 170 days, especially those with price cuts.

- Unrenovated or estate properties, which often scare off other buyers because of the work involved.

If you’re serious about buying now, expect more competition for the best new listings and less flexibility in negotiations. Focus on finding good deals and be ready to act quickly when you see a property you like.

0 Comments