West Village is a highly sought-after neighborhood known for its historic charm, trendy shops, and vibrant dining scene. If you’re considering buying or selling a property in West Village, this blog will provide you with valuable information on current market trends and key insights into the housing market, including the role of brokerage firms in the area. With its prime location in NY, West Village offers a unique and desirable real estate market for both buyers and sellers.

Whether you’re a buyer, seller, or investor, this blog will provide you with valuable insights into the West Village real estate market and help you make informed decisions. Let’s dive in and uncover the insider insights of the West Village real estate market.

Analyzing Trends in the West Village Real Estate Market from the Previous Year

As we analyze the market trends from the previous year in the West Village real estate market, we can gain valuable insights into key indicators such as supply, pending sales, median sale price, monthly contract activity, closed sales, days on the market, market pulse, liquidity pace chart, and price per square foot. These trends provide a comprehensive overview of the market conditions and can help both buyers and sellers navigate the West Village real estate market more effectively.

Supply

In the West Village real estate market, home supply is key for market dynamics. Last year, a steady influx of new homes hit the market, thanks to construction projects. This expanded options for buyers and met demand. Monitoring supply helps buyers time their entries and sellers adjust strategies effectively.

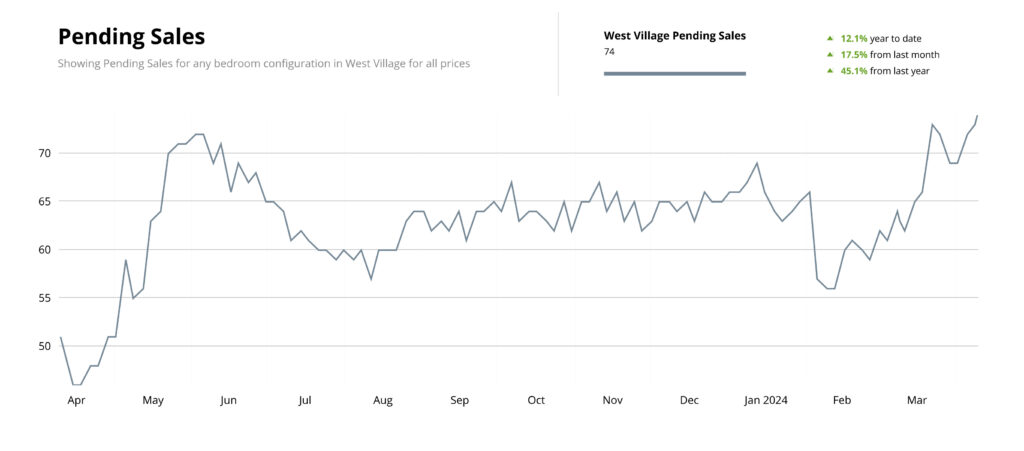

Pending Sales

Pending sales are crucial indicators of buyer interest in the West Village real estate market. Last year, there was a notable surge in pending sales, highlighting robust demand. Factors like location and amenities drove this interest. Monitoring pending sales offers sellers insights into market competitiveness for pricing and marketing strategies. Buyers can use this data to gauge demand and craft competitive offers on desired properties.

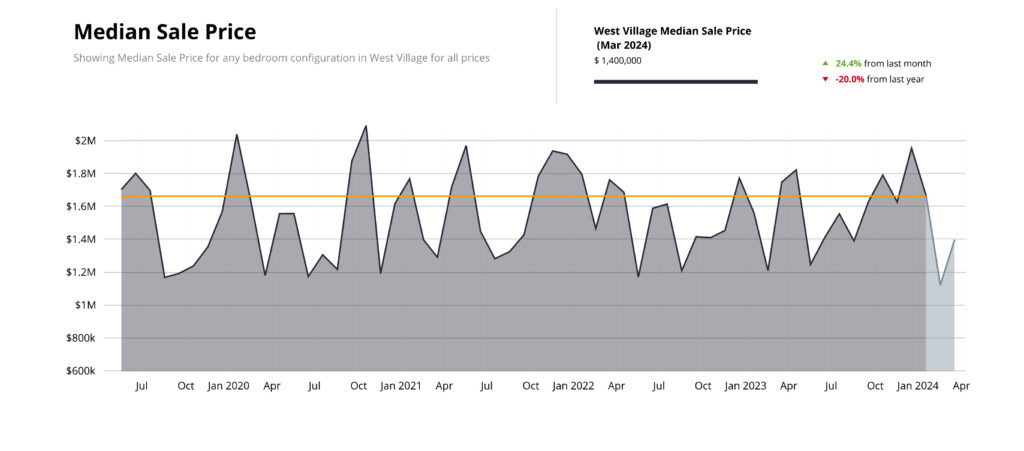

Median Sale Price

The median sale price is crucial in the West Village real estate market, giving a snapshot of home prices. Last year, it stood at $1.6M, with a median sold price of $1.1M, reflecting market trends. Tracking this metric aids both buyers and sellers in decision-making. Buyers assess affordability and negotiate, while sellers refine pricing strategies for competitiveness. The median sale price per sq ft was $2.3K, offering additional value insights.

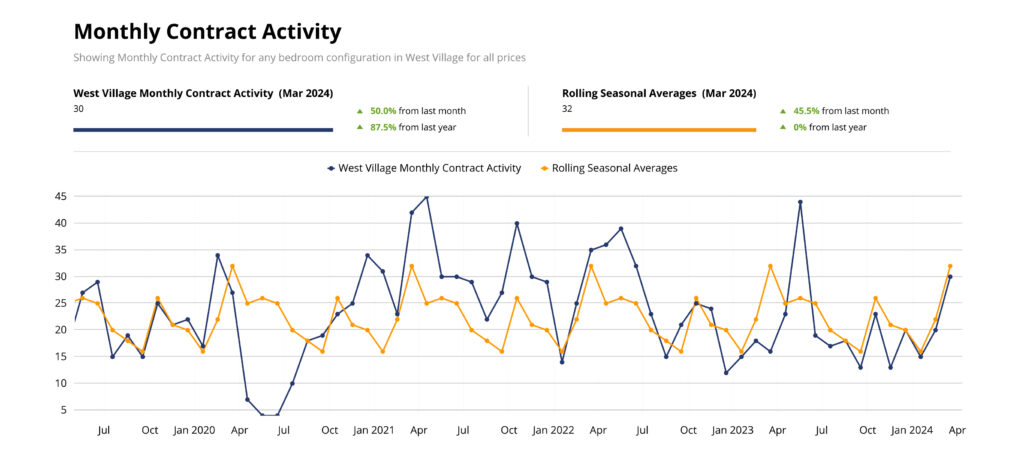

Monthly Contract Activity

Monthly contract activity in the West Village real estate market provides insights into the number of contracts signed for property purchases. In the previous year, the West Village market experienced fluctuations in monthly contract activity. Some key observations include:

- 30 contracts were signed in March compared to February, reflecting a 50% increase.

- Contract activity was highest in June of last year, with a total of 44 contracts signed.

- The average square footage of properties under contract in West Village was 1,200 square feet.

- The most sought-after property types for contract activity were apartments, townhouses, and condominiums.

- The median price per square foot for properties under contract in West Village was approximately $2,000.

By analyzing monthly contract activity, buyers and sellers can gauge market demand, observe trends, and make more informed decisions regarding their real estate transactions.

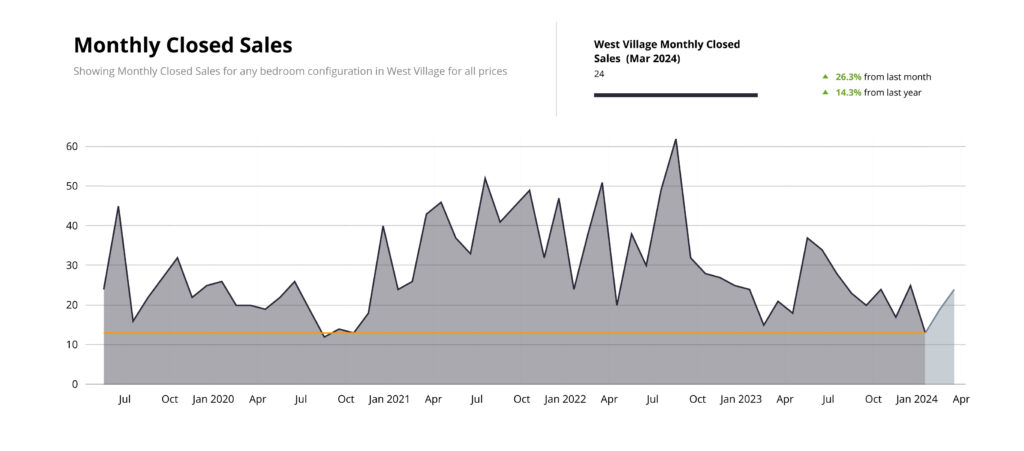

Monthly Closed Sales

Monthly closed sales are vital for evaluating the West Village real estate market’s health. Last year saw fluctuations in these numbers, reflecting transaction activity. Monitoring them aids buyers and sellers in understanding market dynamics and adjusting strategies.

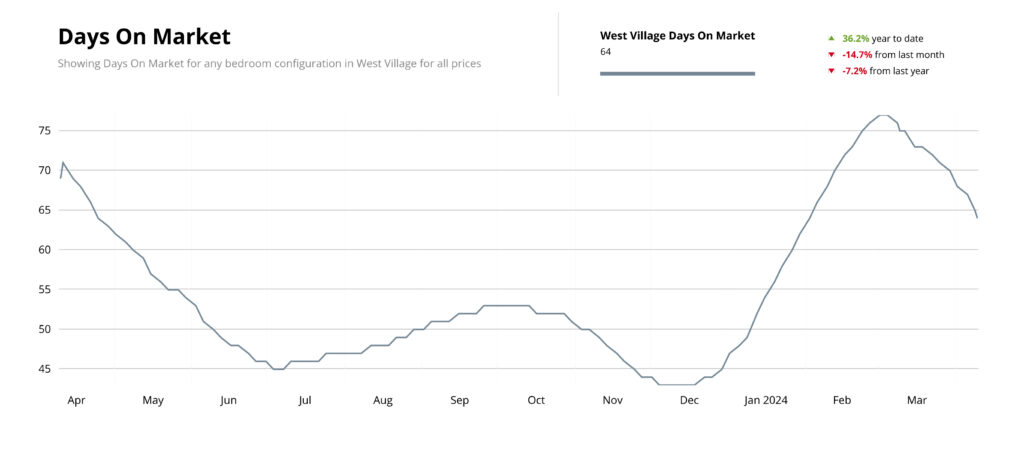

Days on Market

Days on market is a crucial metric measuring how long a property takes to sell in the West Village real estate market. Last year, the average increased from 69 to 64 days, influenced by shifts in demand and market conditions. Monitoring this metric offers insights for both buyers and sellers. Buyers may find negotiation opportunities with longer days on market, while sellers can set realistic expectations and adjust strategies to attract buyers efficiently.

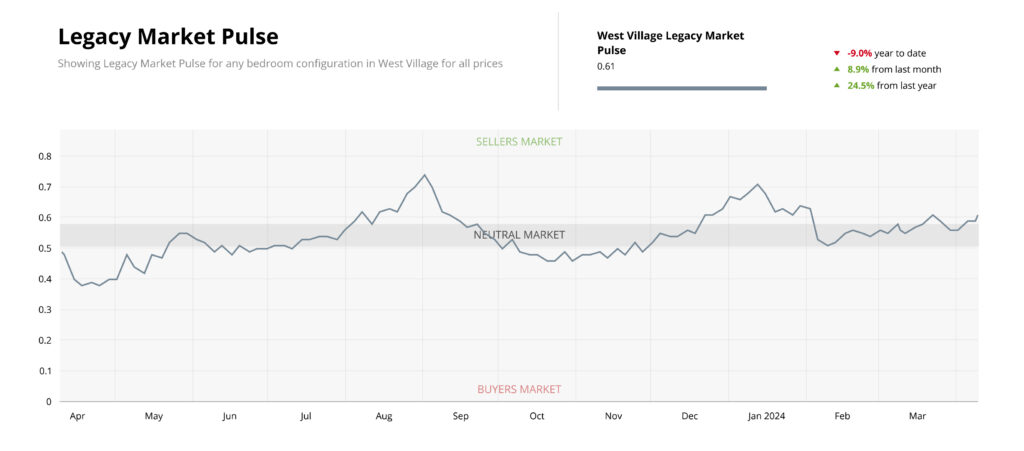

Market Pulse

The market pulse of the West Village real estate offers insight into its health and activity. Buyers use it to time offers, while sellers gauge competitiveness and refine strategies.

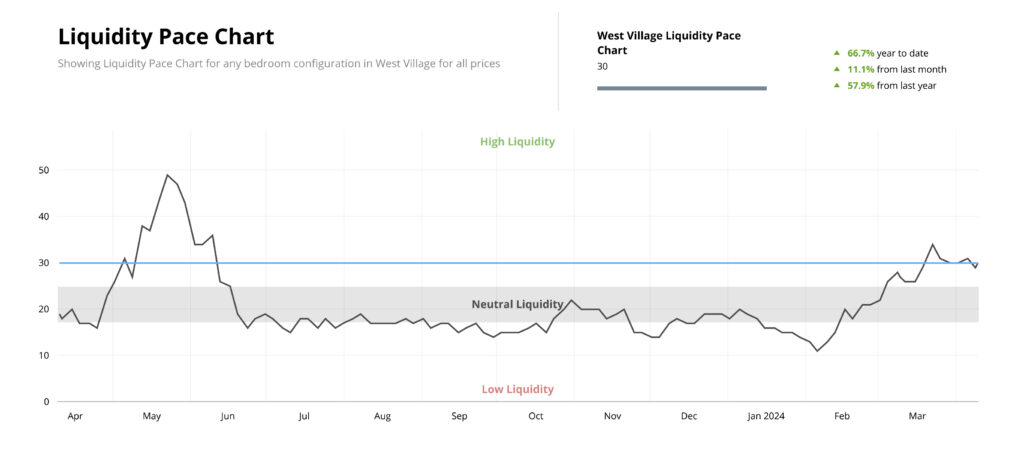

Liquidity Pace Chart

The liquidity pace chart in the West Village real estate market reveals how quickly properties are bought and sold, reflecting market speed and buyer demand levels. Analyzing this chart helps buyers and sellers understand market conditions and make informed decisions. Buyers can adjust strategies based on market speed, while sellers can optimize pricing and marketing to attract buyers promptly.

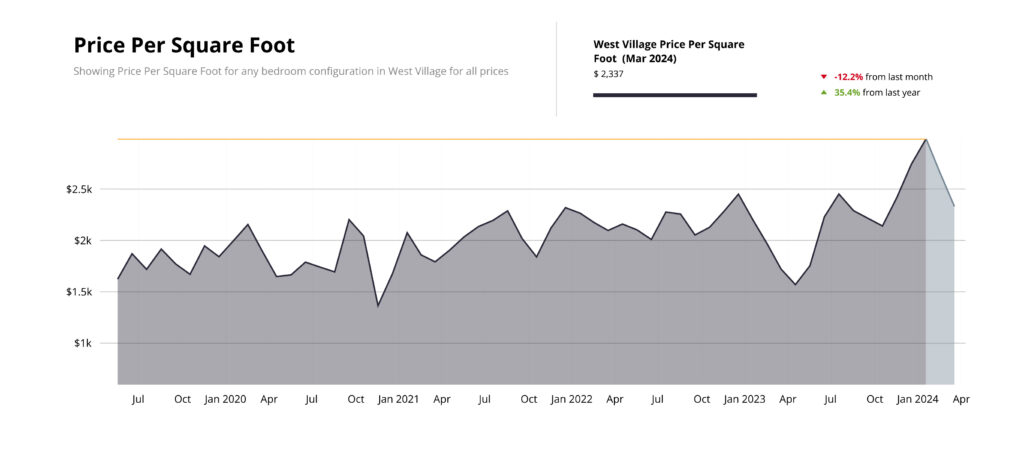

Price Per Square Foot

The price per square foot is a vital metric for assessing property value in the West Village real estate market. Last year, it averaged $1,600, offering insights into market pricing trends. This metric enables buyers and sellers to compare properties based on size and value. Buyers use it to evaluate affordability and value, while sellers set competitive prices and understand their property’s market worth.

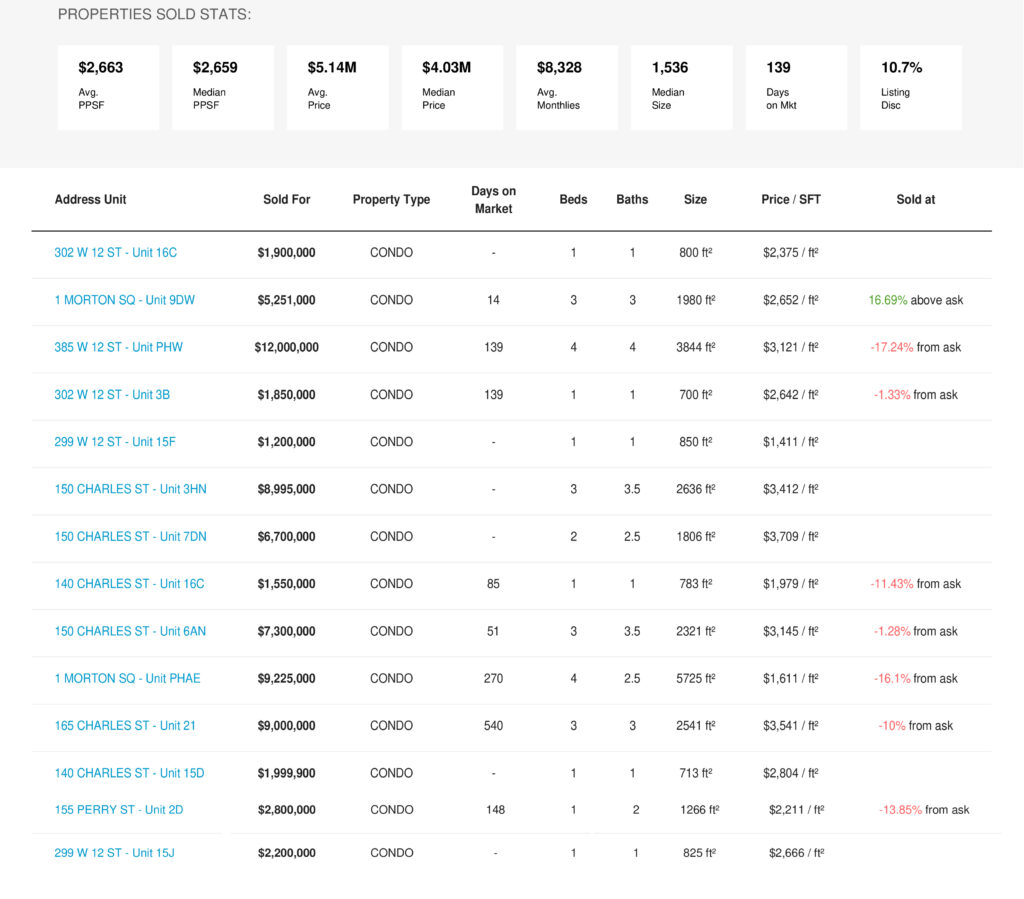

Recently Sold Properties in the West Village

In this section, we will explore recently sold 1-2 bedroom homes in the West Village in the last quarter. These properties provide real-life examples of market activity and can serve as benchmarks for buyers and sellers. Here are some notable recently sold properties in the West Village:

These recently sold properties showcase the diversity of the West Village real estate market and can provide insights into pricing, property types, and market trends.

The Impact of Economic Factors on West Village Property Values

Median listing home price vs. median home sold price

The value of properties in West Village is influenced by a range of economic factors. In this section, we will explore two key factors: interest rates and local employment rates. Understanding the impact of these factors can help buyers and sellers assess property values and make informed decisions.

Interest Rates and Their Influence on Buying Power

Interest rates are pivotal in the West Village real estate market. Low rates empower buyers with favorable mortgages, boosting their purchasing capacity and potentially elevating property demand and values. Conversely, high rates can weaken buyer power, reducing demand and potentially lowering property values.

The Role of Local Employment Rates on Housing Demand

Interest rates are pivotal in the West Village real estate market. Low rates empower buyers with favorable mortgages, boosting their purchasing capacity and potentially elevating property demand and values. Conversely, high rates can weaken buyer power, reducing demand and potentially lowering property values.

The Future of West Village Real Estate

Looking ahead, it’s important to consider the future of the West Village real estate market. In this section, we will provide predictions on market growth and investment opportunities, as well as potential challenges and how to navigate them. By understanding the future outlook, buyers, sellers, and investors can make informed decisions and stay ahead of market trends.

Predictions on Market Growth and Investment Opportunities

The West Village real estate market is poised for continued growth and offers attractive investment opportunities, particularly in the area of West Village apartments. Predictions indicate that market values may appreciate in the coming years, making it an opportune time to invest in properties in the area. With ongoing development projects and a vibrant community, West Village offers a desirable lifestyle and potential for long-term investment returns. By carefully assessing market trends and working with experienced real estate professionals, investors can identify potentially lucrative opportunities in the West Village market.

0 Comments